retroactive capital gains tax hike

Signed 5 August 1997. In some cases you add the 38 Obamacare tax but at worst your total tax bill is 238.

President Joe Biden S Capital Gains Tax Hike Plan Could Legally Become Retroactive Youtube

Are retroactive tax increases constitutional or even fair.

. Critics of the plan say it will hurt investment and economic growth by penalizing gains. Private equity is an investment class structured as a partnership agreement between an expert investor and individuals with capital. Biden plans to increase the top tax rate on capital gains to 434 from 238 for households with income over 1 million though Congress must OK any hikes and retroactive effective dates the.

Financial advisers say Bidens retroactive capital-gains tax hike gives them wiggle room Last Updated. Reduced the maximum capital gains rate from 28 percent to 20 percent. Effective for taxable years ending after 6 May 1997 ie for the full calendar year in.

Treasury Secretary Janet Yellen suggested in remarks before a Senate panel that if Congress were to pass a capital-gains tax hike effective starting in April 2021. Advisors look for ways to lessen Bidens proposed retroactive capital gains tax hike President Joe Biden unveiled a budget proposal Friday calling for a 396 top capital gains tax rate matching previous. But many were taken off guard by the May 2021 announcement that the increase would be implemented retroactively with a potential start date as early as April 2021.

Financial advisers say Bidens retroactive capital-gains tax hike gives them wiggle room. In the months since President Biden announced his tax reform proposal that included a tax hike on income recognized from capital gains investors have been keeping a close eye on the political climate and the likelihood that this change would be enacted. This news is not surprising but it rather buries the lede.

For taxpayers with income of over 1 million long-term capital gains will be taxed at ordinary rates. One idea in play is a retroactive capital gains tax increase raising the top tax rate currently 238 percent imposed on the gain from the sale of assets held longer than a year9 President Bidens budget proposal suggested raising the rate on such capital gains to 434 percent for households with income over 1 million effective for all sales on or after April 2021. In some cases you add the 38 Obamacare.

What caught most everyone off guard is the. Up until now the tax rate on capital gain has been zero 15 or 20 depending on your income. President Joe Bidens proposal to raise the capital-gains tax rate to 396 from 20 for those earning 1 million or more was first announced April 28 as part of the administrations American.

The capital gains tax hike would be retroactive to the date of announcement making it. Seeking a retroactive effective date on a capital. 5 things to know this weekend.

As expected the Presidents proposal would increase the top marginal ordinary income tax rate from 37 to 396 and would apply ordinary income tax rates to capital gains realized by taxpayers with income in excess of 1 million annually. House Democrats on Monday proposed raising the top tax rate on capital gains and qualified dividends to 288 one of several tax reforms aimed at. May 28 2021 at 359 pm.

June 16 2021 1108 AM PDT. A Multimillion-Dollar Sale No. Capital Gains Tax 101 Capital Gains Tax 101 2021 And 2022 Capital Gains Tax Rates Forbes Advisor.

Are retroactive tax increases constitutional or even fair. Currently there are only 3 federal tax rates on capital gain income which are simply 0 15 or 20. Perhaps the most newsworthy item in the Treasury Department Greenbook was the Biden Administrations proposal to increase taxes on capital gains on a retroactive basis.

Tax carried interest capital gains as ordinary income. Capital gains on investments can result in triple-taxation. One idea in play is a retroactive capital gains tax increase raising the top tax rate currently 238 percent imposed on the gain from the sale of assets held longer than a year9 President Bidens budget proposal suggested raising the rate on such capital gains to 434 percent for households with income over 1.

Even if the capital gains increase is retroactive they would still save money because the capital gains would be based on a 37 marginal tax rate instead of 396. Specifically the Greenbook proposes to tax long-term capital gains and qualified dividends of taxpayers with adjusted gross income of more than 1 million at ordinary. Financial advisers say Bidens retroactive capital-gains tax hike gives them wiggle room Andrew Keshner 5312021 New COVID test rule Winter Storm Izzy NFL playoffs.

So its no surprise that President Biden is calling for significant capital gains increases for income above 1 million hoping to raise the capital gains rate at that level from 20 to 396. 66 billion tax increase Carried interest is the tax treatment for investment made by private equity investors. The long term capital gain tax is graduated 0 on income up to 40000 15 over 40000 up.

Date Published 08072021. Accordingly there is nothing stopping Congress from passing the Biden tax plan and making the proposed 396 top capital gains rate retroactive to some point earlier this year. Up until now the tax rate on capital gain has been zero 15 or 20 depending on your income.

May 31 2021 at 1250 pm. The retroactive aspect of the tax hike is a tacit admission that such a large tax hike is likely to change investor behavior as taxpayers seek to avoid paying such an elevated rate.

Biden S Proposed Retroactive Capital Gains Tax Increase

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

Biden S Ex Post Facto Capital Gains Tax Increase Wsj

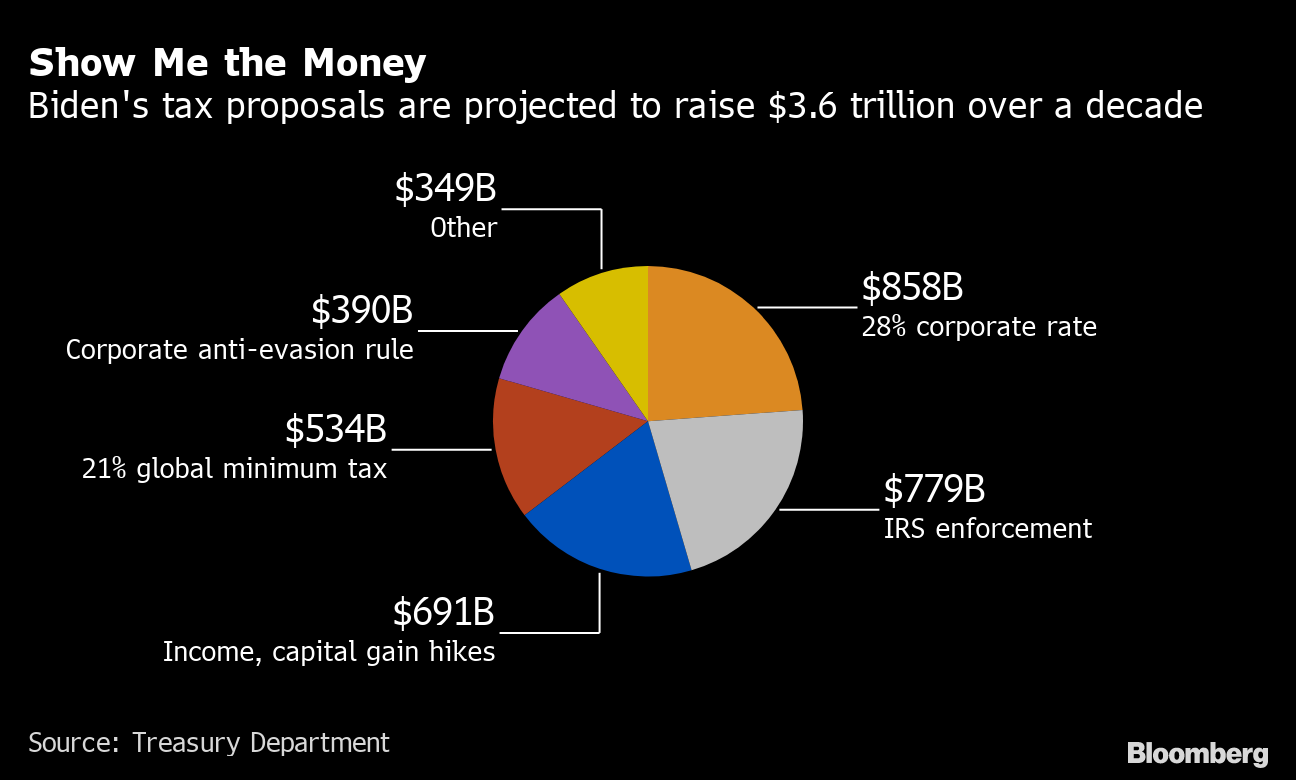

Biden Tax Plan Is Forecast To Bring In 3 6 Trillion Over Decade

Biden Budget Reiterates 43 4 Top Capital Gains Tax Rate For Millionaires

Wall Street Panicking That Biden S Tax Hikes Will Be Retroactive

Wall Street Panicking That Biden S Tax Hikes Will Be Retroactive

Advisers Blast Biden S Retroactive Capital Gains Proposal

Understanding The Proposed Retroactive Capital Gains Tax Rate Increase Frazier Deeter Llc

.png)

Biden S Green Book Includes Retroactive Capital Gains Tax Increase Husch Blackwell Llp Jdsupra

What Can The Wealthy Do About Biden S Proposed Tax Increases

Biden Budget Said To Assume Capital Gains Tax Rate Increase Started In Late April Wsj

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

Possible Retroactive Capital Gains Hike Panics Investors Qsbs Holders Could Be At Risk Qsbs Expert

Biden S Ex Post Facto Capital Gains Tax Increase Wsj

Capital Gains Tax Hike Would Imperil Active Mutual Funds Bloomberg

Retroactive Effective Date For Capital Gains Tax Increase Is A Bad Idea

/https://specials-images.forbesimg.com/imageserve/61184c5c931401c2f3cbf648/0x0.jpg)

Critics Sound The Alarm Over Possible Retroactive Capital Gains Tax Hike Elevage La Gabriere