michigan property tax rates by township

Lansing MI 48917 Assessing Home. According to the township the average homeowner will.

Detroit S High Property Tax Burden Stands As An Obstacle To Economic Growth Citizens Research Council Of Michigan

Box 87010 Canton MI 48187 Online Tax Payment We accept cash personal checks bank checks MasterCard Discover and Visa.

. There is a 395 charge. WILX - Starting Jan. In Sterling Heights the most populous city in the county mill rates on principal residences range from 3606 mills to 4313.

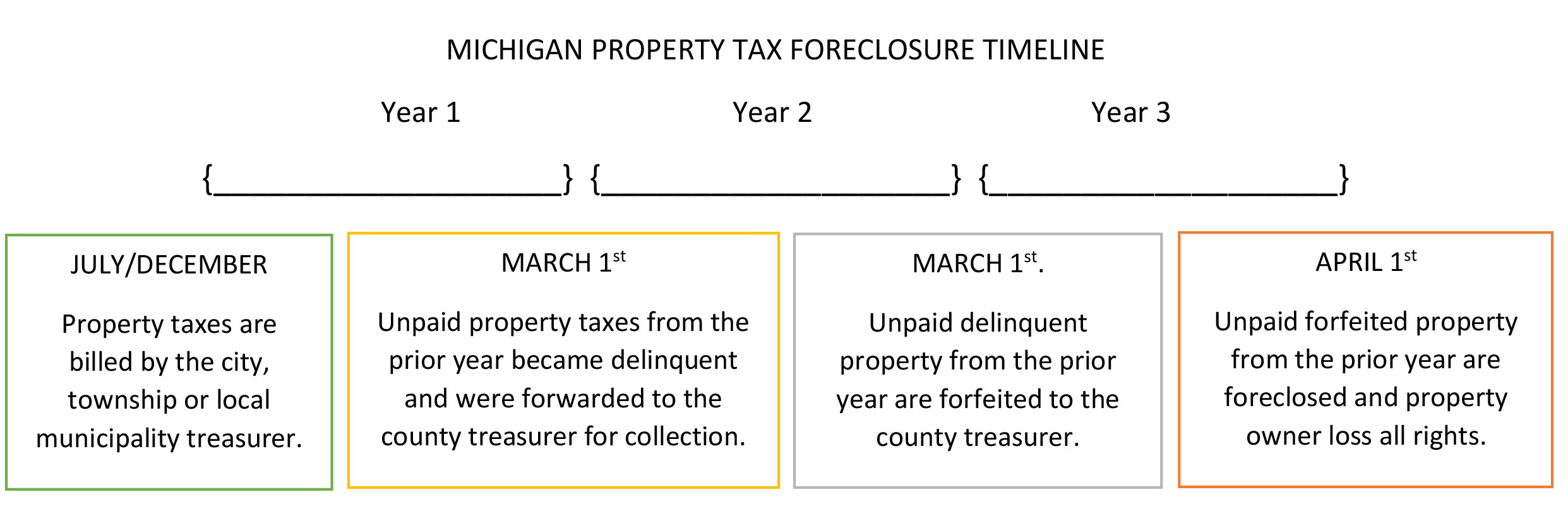

Tax amounts do include a Solid Waste rubbish collection fee of 15500 but do not include the 1 administration fee or any special assessments. Property is forfeited to county treasurer. Real and personal property taxes are the combined total.

All tax bills are mailed out at the same time by. 14 hours agoMERIDIAN TOWNSHIP Mich. Median property tax is 214500 This interactive table ranks Michigans.

State Summary Tax Assessors Michigan has 83 counties with median property taxes ranging from a high of 391300 in Washtenaw County to a low of 73900 in Luce County. Rates also include special. Pursuant to the State of Michigan General Property Tax Act 206 MCL21144 we cannot waive any interest or fees for any reason.

Homeowners For existing homeowners. Canton Township Treasurer PO. The Pittsfield Township 2019 Total Tax Rate of 64381 breaks down in the following way.

Rates include the 1 property tax administration fee. The Millage Rate database and Property Tax Estimator allows individual and business taxpayers to estimate their current property taxes as well as compare their property taxes and millage. 84 rows Michigan.

Rates include special assessments levied on a millage basis and levied in all of a township city or village. Whether you are already a resident or just considering moving to Bangor Township to live or invest in real estate estimate local property. 1 2023 water and sewer rates will increase in Meridian Township.

Delta Township MI Assessing Ted Droste MMAO AssessingBuilding Director Contact Email Assessing Township Hall 7710 West Saginaw Hwy. Taxes Tax Comparison Ordered by Millage Rate. Learn all about Bangor Township real estate tax.

Information regarding personal property tax including forms exemptions and information for taxpayers and assessors regarding the Essential Services Assessment. The average effective property tax rate in Macomb County is 168. Interest increases from 1 per month to 15 per month back to 1st prior year.

The school district your property is located in determines the annual millage rates applied to calculate the taxes on your property. County Treasurer adds a 235 fee.

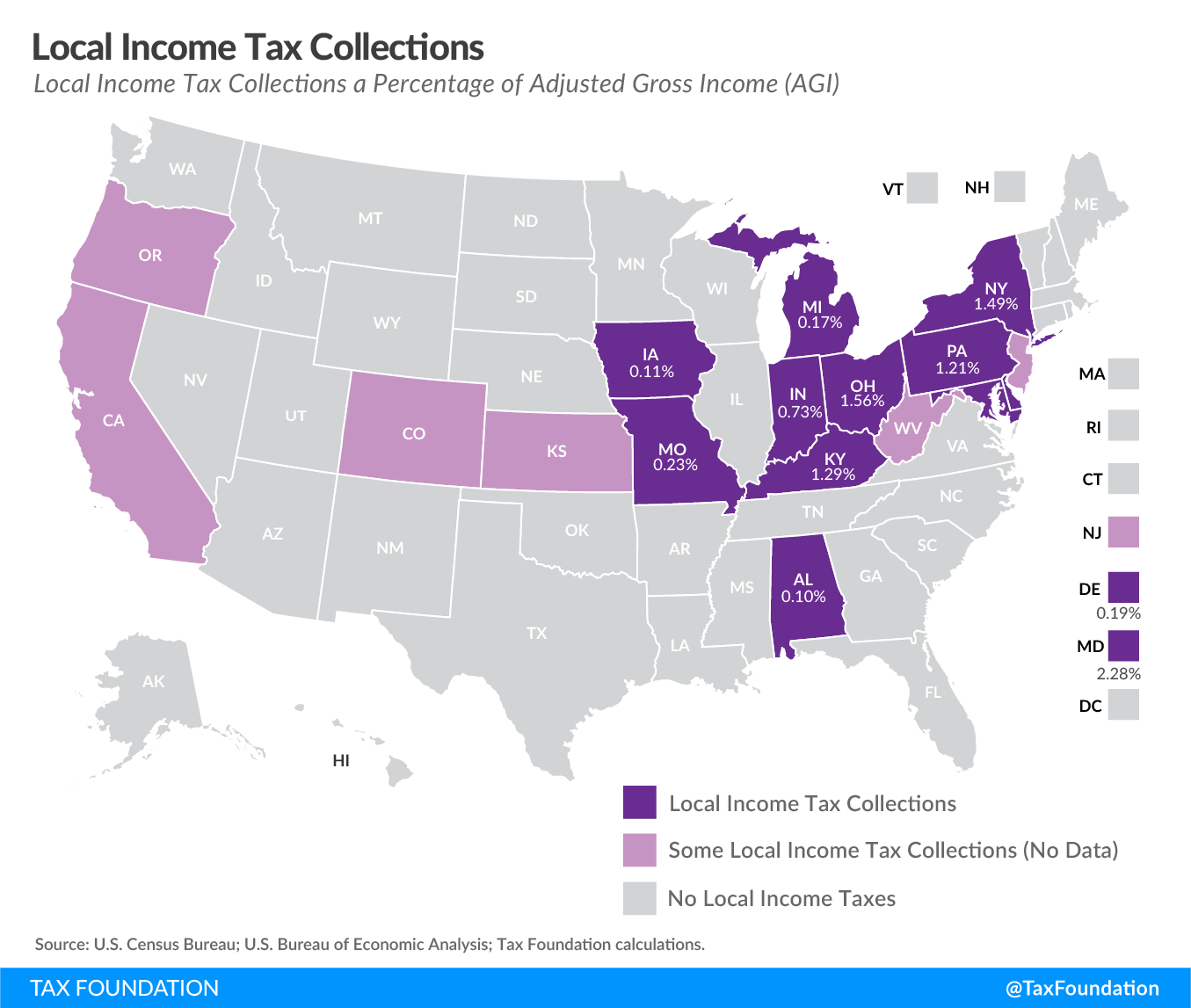

Local Income Taxes In 2019 Local Income Tax City County Level

Compare 2021 Millage Rates In Michigan Plus Fast Facts On Property Tax Trends Mlive Com

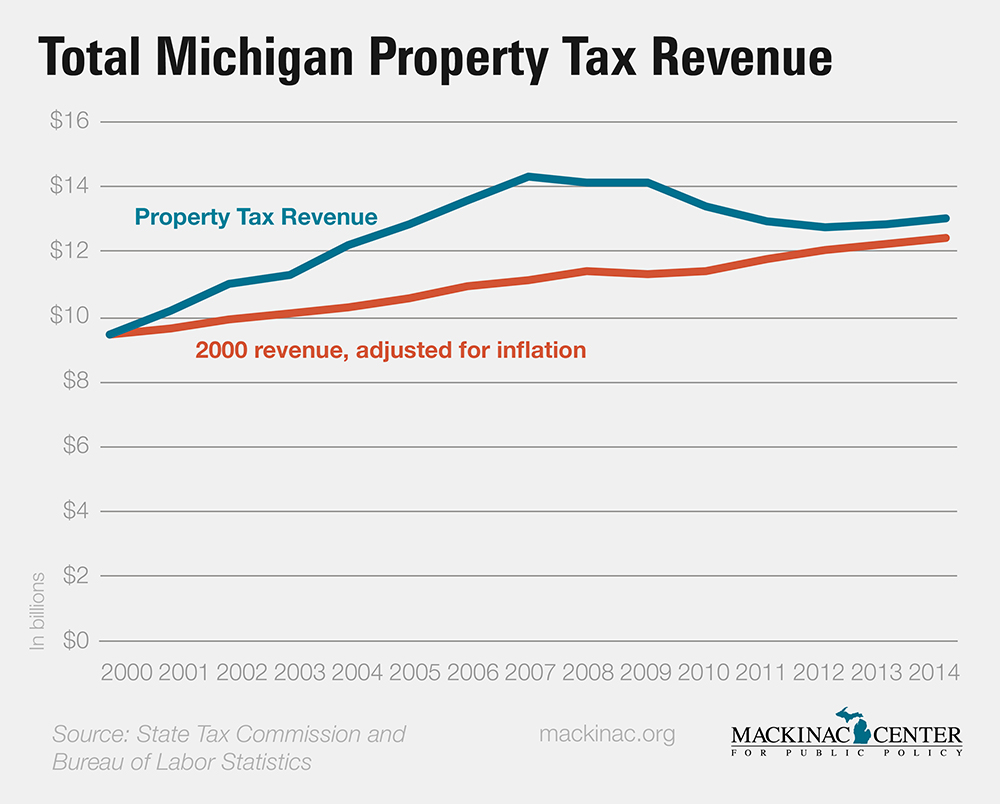

Michigan S Property Tax Burden And How It Has Changed Over Time Citizens Research Council Of Michigan

Michigan Property Tax Revenues Up Mackinac Center

What Michigan Communities Had The Highest Property Tax Rates In 2019 Here S The List Mlive Com

Analysis Detroit Enjoys Highest Per Capita Revenue In State Thanks To High Diversified Tax Rates Mlive Com

A Look At Michigan S Local Income Taxes Drawing Detroit

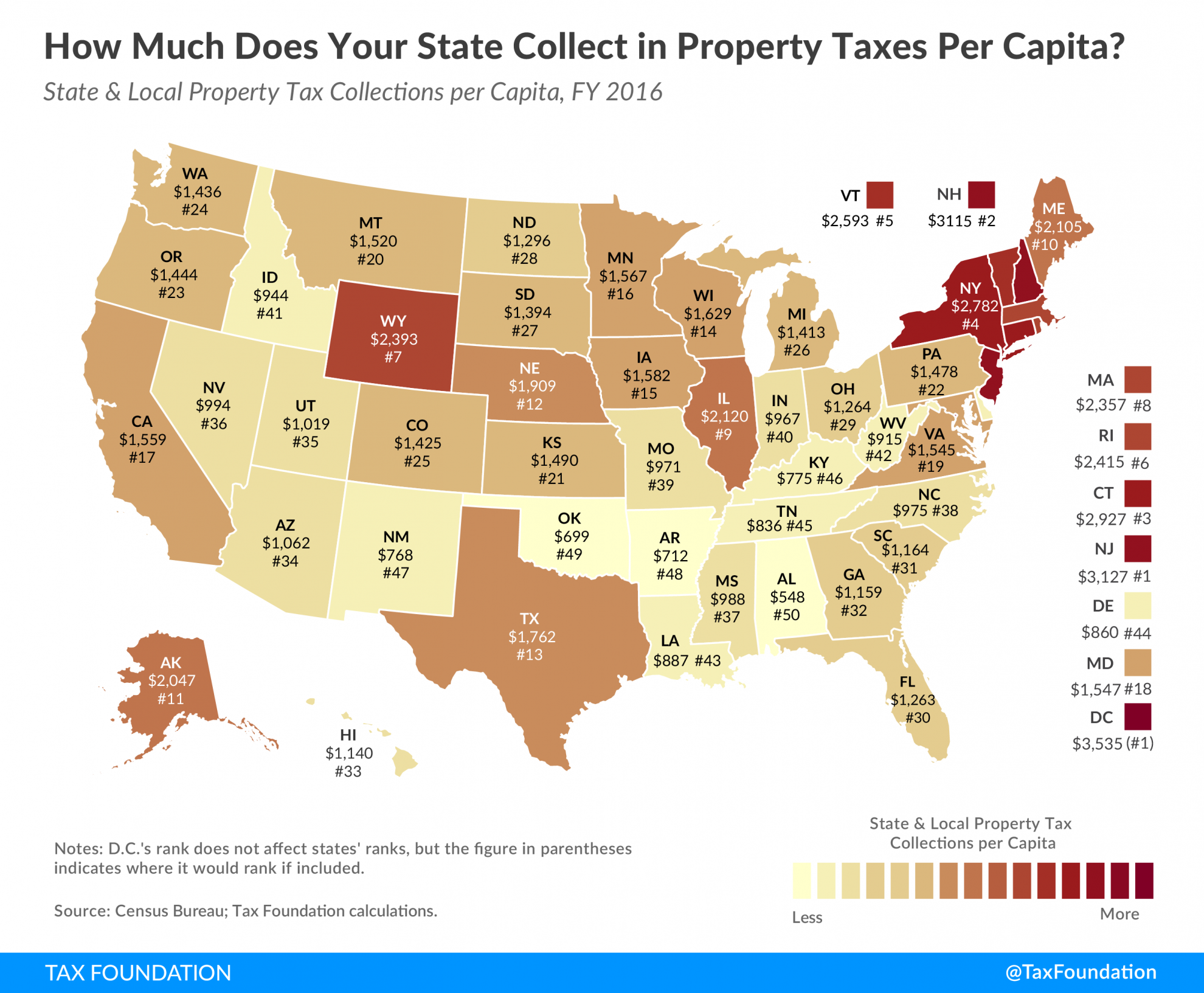

Property Taxes Per Capita State And Local Property Tax Collections

Homeowners Property Exemption Hope City Of Detroit

50 Communities With Michigan S Highest Property Tax Rates Mlive Com

Property Tax Calculator Estimator For Real Estate And Homes

Michigan Townships Association Mi Twps Top 10 List Of Why Townships Offer Value Service Number 1 Meeting Local Needs Michigan S 1 240 Townships Govern 96 Percent Of The State S Land And

Macomb Township Voices Urgent Appeal Your Property Tax Assessment March 8 10 By Zoom With Your Township Or City Board Of Review Facebook

Southeast Oakland County Real Estate Markets Find Property Tax Rates

How To Understand And Challenge Your Property Taxes In Michigan

Michigan Sev Values Tax Burdens And Other Charts Maps And Statistics

How Do State And Local Property Taxes Work Tax Policy Center

U S Cities With The Highest Property Taxes

State Tax Treatment Of Homestead And Non Homestead Residential Property